The Fast Grower No One Saw Coming: How DAVE Quietly Became a Fintech Juggernaut

From cash burn to cash machine — a deep dive into the misunderstood neobank that's beating estimates, compounding margins, and flying under Wall Street’s radar. This could be your next multi-bagger.

DAVE 0.00%↑ is a neobank fintech focused on helping Americans avoid overdraft fees and access small cash advances through its mobile app . The company targets the underserved “paycheck-to-paycheck” population, providing features like “ExtraCash” advances up to $500, spending accounts with debit cards, and tools to find side gigs. This addresses a massive pain point – an estimated 100+ million U.S. adults live paycheck-to-paycheck or struggle with emergency expenses . Dave’s app has garnered over 10 million users historically , with 2.5 million Monthly Transacting Members (MTMs) as of Q1 2025 (up 13% year-on-year) . This indicates significant runway remaining in a large Total Addressable Market, as tens of millions more Americans frequently incur overdrafts or lack access to affordable credit.

📌 Basic Info

Ticker / Company Name: DAVE / Dave Inc.

Market Cap: ~$2.4B

Sector / Industry: Fintech / Neobanking

Country / Listing Exchange: USA / Nasdaq

Stock Type: High Grower / Turnaround

Product Differentiation

Dave’s core appeal is providing fee-free (tip-based) cash advances to cover small shortfalls, avoiding the typical $35 bank overdraft fees. The platform has been highly rated by users (4.8★ on Apple’s App Store with 725k+ reviews ), suggesting strong product-market fit. Its ExtraCash advances arrive in minutes, and the app now offers 4% APY on checking deposits and credit-building tools , adding more value than basic payday loan apps. Recent changes to the fee model (eliminating the old optional “tips” and expedited transfer fees) aim to improve transparency and have boosted monetization per user without hurting retention, according to management.

1. Management Alignment

Insider ownership: 21%

Equity-heavy compensation: Yes

Insider buying: No recent selling, initiated buyback

Capital allocation history: Growth-focused, disciplined cost control, recently initiated share buybacks.

DAVE 0.00%↑ is led by co-founder and CEO Jason Wilk, who has steered the company from startup through SPAC merger. Wilk and insiders retain significant ownership – insiders hold 21% of the shares , which strongly aligns management’s incentives with shareholders. Equity compensation is a factor (typical of fintech startups), but the insider ownership and recent insider behavior are encouraging.

In the last 90 days, there were no insider sales reported ; instead, the company buying back stock is a vote of confidence. Capital allocation so far has been growth-centric (investing in customer acquisition, technology, and loan receivables), but management has shown discipline by keeping customer acquisition costs low (CAC was just $18 per new member in Q1 2025 ) and now pivoting to profitability. The decision to modify the fee structure in late 2024 even at risk of short-term user backlash demonstrates proactive management adapting to regulatory feedback and seeking a more sustainable revenue mode.

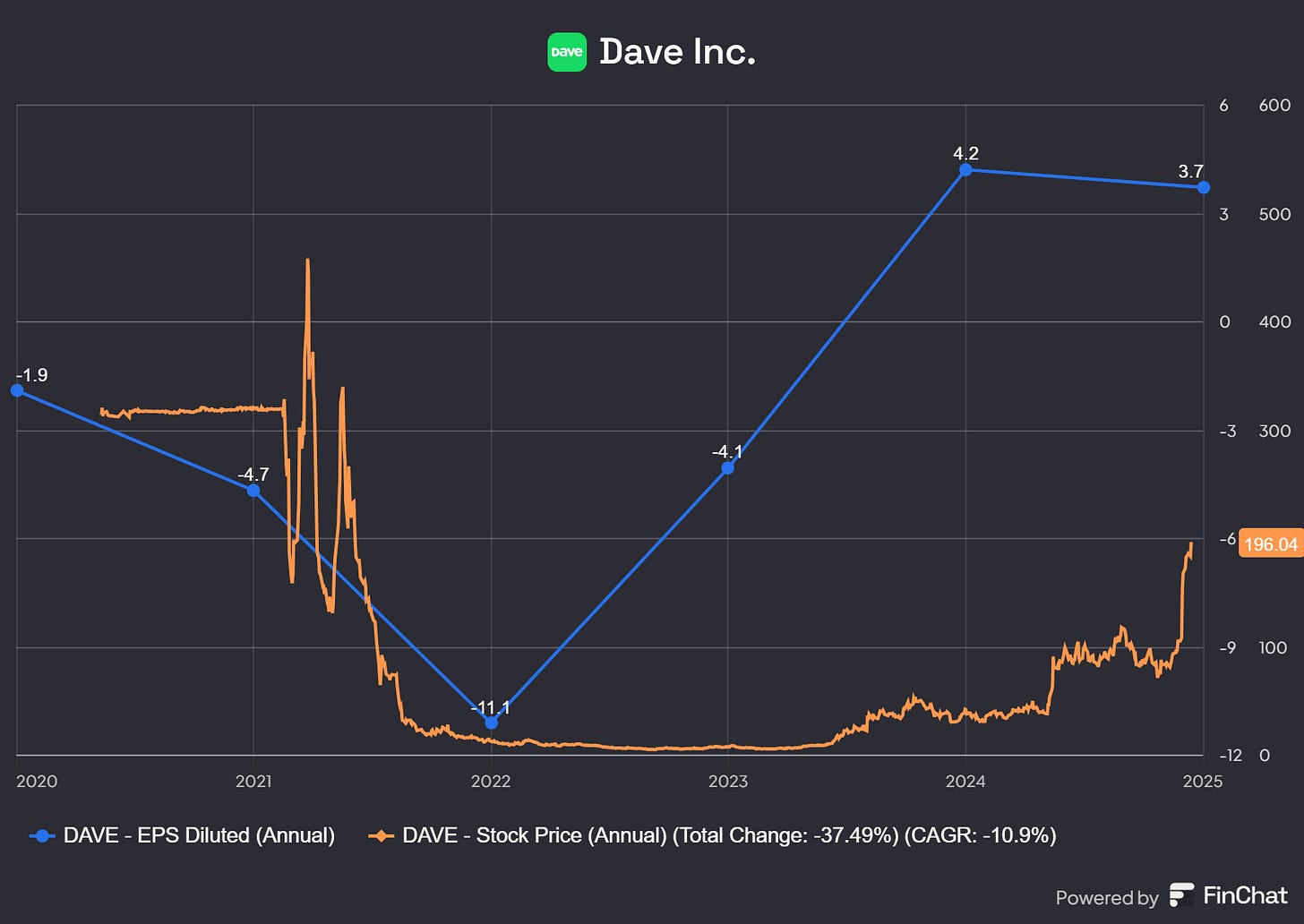

2. EPS Trend

3–5Y historical EPS: Negative, recently turned positive

2Y forward EPS estimates: $9.50–$10 (increasing)

3. Earnings Surprise History

Beat/Miss %: 87.5% beat rate last 4 quarters

Beat magnitude: Significant, consistently above analyst expectations

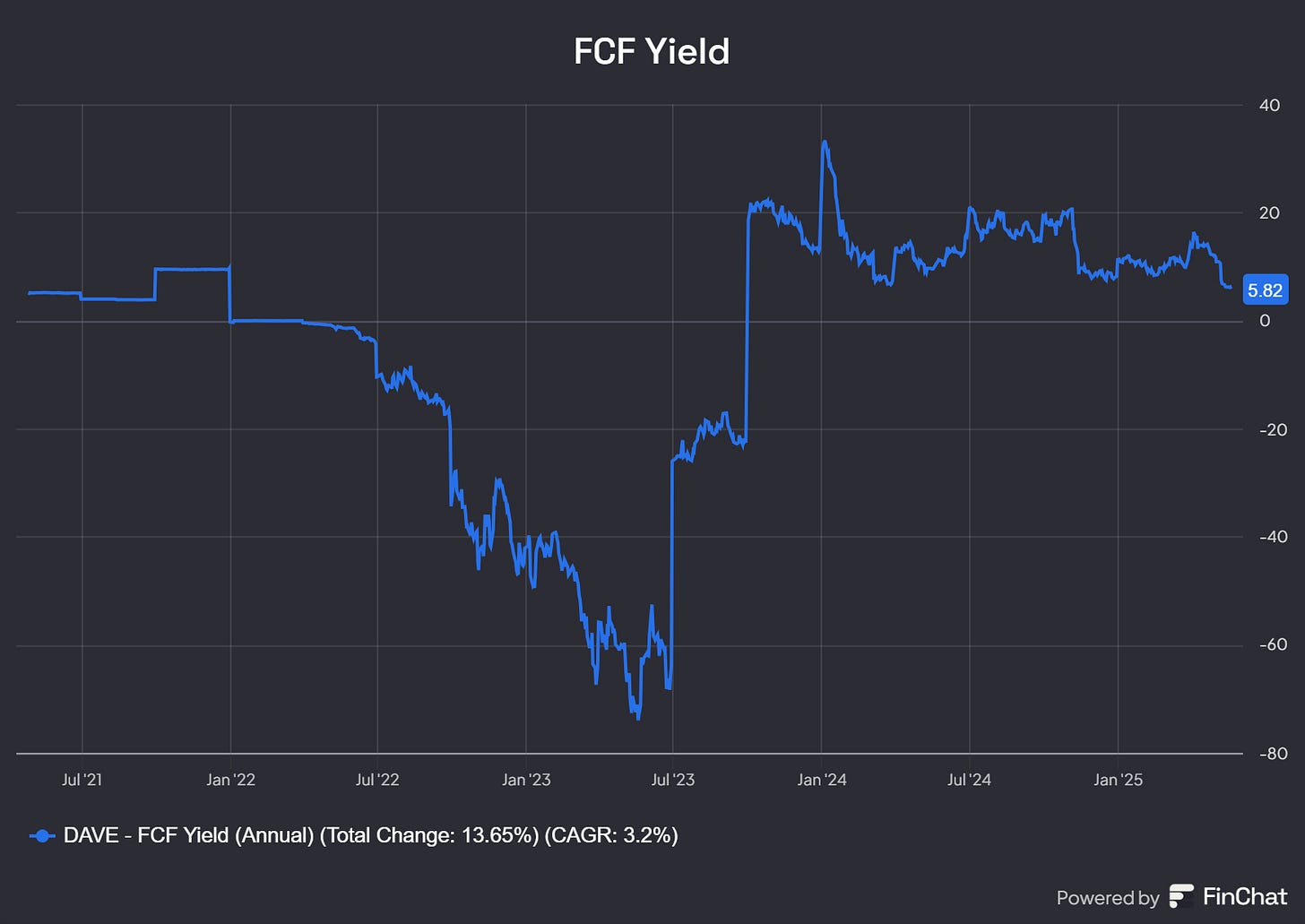

4. Valuation

23X NTM EPS

16X NTM EV/EBITDA

5.8% FCF Yield

Relative to peers

Attractive relative to growth and peers ( SOFI 0.00%↑ , ML 0.00%↑ )

Dave operates in a crowded fintech space (neobanks, earned-wage access apps, etc.) alongside players like Chime, MoneyLion, SoFi, EarnIn, and even traditional banks adapting to lower overdraft fees. The competitive moat is narrow, features like early wage access and no overdraft fees can be copied by others.

However, Dave’s head start in AI-driven underwriting (“CashAI”) and its engaged user base are strengths. Notably, delinquency rates on Dave’s advances hit record lows (1.50% 28-day delinquency) in Q1 2025 , implying their risk models are effectively managing credit risk – a critical factor in this business. The industry backdrop is favorable in that many Americans still need better shortterm financial tools; on the other hand, big banks eliminating overdraft fees and other fintechs offering cash advances represent ongoing competitive pressure.

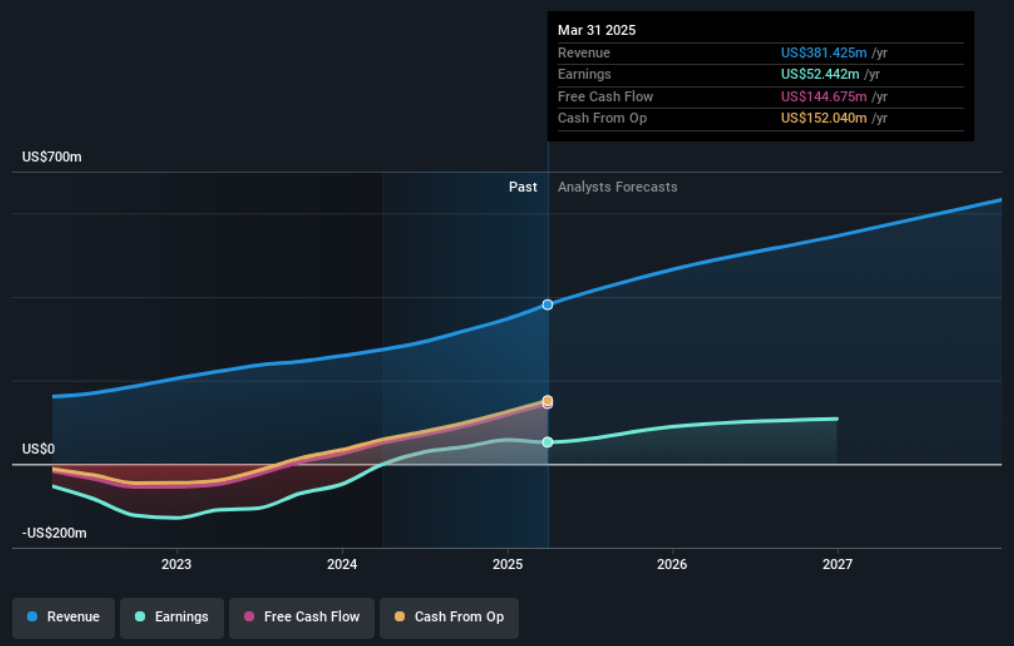

5. Growth Potential

Revenue CAGR: ~30–35%

EPS CAGR: >100% (inflection to profitability)

FCF CAGR: Rapid positive shift

TAM: ~150M underserved adults in the US

Gross margins: ~70% variable profit margin

Dave’s financial growth has been impressive. Revenue rose 34% in 2024 to $347.1 million , up from $259M in 2023 and $205M in 2022 . This ~30%+ CAGR topline growth is projected to continue: analysts expect ~$465M revenue in 2025 (~33% YoY) . Notably, Q1 2025 revenue was $108.0M (+47% YoY) , marking an acceleration thanks to the new fee model and higher monetization. Dave’s user base growth (MTMs +13% YoY) is more modest, so much of the revenue surge is from higher average revenue per user (ARPU) – management noted improvements in unit economics and lifetime value per member under the new fees . This suggests significant operating leverage: indeed, non-GAAP variable profit margin hit 77% in Q1 2025 , nearly double three years ago. As revenue scales, costs are not rising in tandem, driving rapid improvement in profitability.

6. Blow-Up Risk

DAVE 0.00%↑ had $89.7M in cash, equivalents and securities as of Mar 31, 2025 , providing a liquidity cushion. It also has an external credit facility (led by Victory Park Capital) of $100M to support loan originations , with ~$75M drawn.

With the business now generating cash and a modest debt facility, Dave appears to have sufficient capital to fund growth in the near term. In fact, confidence in its financial position led the Board to authorize a $50M share repurchase in Q1 2025, of which over $20M was executed in late Q1 . This is a notable positive – a small-cap growth company returning capital to shareholders, reflecting management’s view that the stock is undervalued relative to fundamentals

Debt levels: Manageable. $88M Cash, $75M drawn on a $100M facility

Governance or legal issues: DOJ lawsuit over past fee practices

Industry disruption risk: High, competitive fintech landscape

7. Technical Setup

Price vs. 50/150/200DMA: Above moving averages, strong bullish trend

Trend stage: Stage 2 (rapid growth)

8. Achievability of Consensus

Execution required: Continued member growth and ARPU improvement

Realistic assumptions? Yes, conservative relative to recent execution

9. Analyst Coverage

# of analysts: Growing coverage

Initiations recently: Several positive revisions

10. Growth Drivers

Top 2–3 catalysts: New fee structure (better monetization), user growth acceleration, improved AI-driven underwriting (CashAI)

11. Risks

Regulatory/Litigation Risk: The DOJ/FTC lawsuit is the biggest overhang. It alleges that Dave misled users with hidden fees and seeks unspecified penalties and a ban on future violations . While Dave has changed its fee model (which might appease regulators), an unfavorable ruling or hefty settlement could hit financials or force further business changes. Regulatory scrutiny on fintech and earned wage access is rising generally, so Dave will need impeccable compliance going forward.

Credit Risk & Macroeconomy: Dave’s revenue is tied to the health of its customer base. In a recession or rise in unemployment, more users might default on advances (despite being small amounts). Higher loss rates would directly increase Dave’s provision for credit losses (which it books up-front on each advance) and could erode its recent profitability. Additionally, if interest rates stay high or rise, the cost of Dave’s credit facility funding could squeeze margins (though Dave did secure a ~200 bps rate reduction on its facility in 2023).

Competition & Margin Pressure: Big banks and fintech peers could undercut Dave. For example, if mainstream banks all eliminate overdraft fees, the impetus to use Dave diminishes. Competitors might offer larger advances or reward customers more, forcing Dave to spend more on marketing or lower its fees. Dave’s CAC is impressively low now ($18) , but increased competition could drive it up, slowing growth or eating into margins. The neobank space has few barriers – brand and user experience are key, so any slippage in Dave’s app quality could send users to alternatives.

Execution Risk: Now that Dave is scaling profitability, expectations will be high. The company must execute quarterly growth without hiccups. Any sign of growth deceleration beyond the planned moderation (e.g., MTMs stagnating or ARPU gains leveling off) could hurt the stock given its already rich pricing of future growth. Likewise, if the new fee model unexpectedly causes churn or user dissatisfaction (even though retention has held so far ), that would be a red flag.

SPAC Legacy and Share Structure: Dave came public via SPAC and had to do a reverse split to maintain listing – not uncommon, but it means there are warrants and possibly earn-out shares in the structure. Most of those are likely accounted for (warrant liabilities on the books are small ), but any conversion of warrants could modestly dilute shareholders (albeit at much higher prices). Also, with the stock up so much, insiders or PIPE investors from the SPAC might choose to sell some holdings, which could create stock supply in the market.

12. Moat / Competitive Advantage

Limited moat, but strong brand and early mover in AI-driven underwriting

13. Optionality

Unpriced growth drivers: Expansion into larger loan products, partnerships, acquisitions

14. Customer Sentiment

4.8★ Apple App Store (725k+ reviews)

Recurring complaints: Past fee transparency issues (recently addressed)

★ Our Take

Dave Inc. transitioned from a cashburning startup to a profitable, scalable platform addressing a vast underserved market. The company has demonstrated operating leverage translating revenue growth into exponentially higher earnings and management’s recent moves (fee model overhaul, cost discipline, share buybacks) inspire confidence.

We classify Dave as a “Fast Grower” stock with turnaround characteristics, meaning it offers the prospect of substantial returns if current momentum continues. At 5X forward sales and 23X forward earnings, the stock’s valuation does not fully reflect the 30%+ growth and 30%+ margins Dave is now producing.

In an optimistic scenario, Dave could compound earnings rapidly and be worth significantly more (the stock’s 12-month analyst targets up to $229/share underscore this potential ). The asymmetric upside comes from its small base: capturing even a single-digit millions more of the potential user pool or introducing a new revenue stream (e.g. larger loans, subscriptions) could drive outsized financial gains.

Risk/Reward Profile

We view Dave’s risk/reward as favorable for aggressive investors. The downside is real but appears limited to perhaps the low hundreds (or lower if multiple shocks occur), whereas the upside in 1–3 years could be a stock in the high $300s if Dave continues outperforming. This positive skew – the possibility of doubling vs the risk of a 30-50% pullback – is what makes Dave intriguing. The company’s financial stability (positive cash flow, cash on hand) also reduces the risk of dilution or distress, which often plagues small-cap growth stocks.

⭐ My PT: $268 Base, $347 Bull, $141 Bear

DAVE has already rerated—but the market still hasn’t priced in what happens if they simply stay the course.

At 77% margins, 30%+ top-line growth, and rising GAAP profitability, the setup here is about durability, not reinvention. The optionality (larger loans, cross-selling, M&A) is a bonus. If they just keep executing—expanding ARPU, controlling CAC, and compounding FCF—the base case unlocks naturally.

The bear case: DOJ litigation goes sideways or credit metrics deteriorate sharply. But even then, DAVE isn’t going back to unprofitable burn—it’s now a self-funded business with operating leverage and defensible unit economics.

The bull case: More beats. Faster monetization. TAM expansion. And multiple expansion from a still-underappreciated growth/FCF profile.

It’s not “dirt cheap” anymore — but it might still be early.

📜 Disclosure

I currently hold a long position in Dave Inc. ( DAVE 0.00%↑ ) at the time of writing. This write-up reflects my personal opinion and analysis, developed from publicly available information, filings, and earnings reports. It is intended for informational and educational purposes only and should not be considered investment advice, a recommendation, or a solicitation to buy or sell any securities.

Investing in equities—particularly in small-cap or high-growth companies like Dave—involves significant risk, including the risk of total capital loss. Always do your own due diligence and consult with a registered financial advisor before making investment decisions.

I reserve the right to buy, sell, or otherwise change my position in DAVE 0.00%↑ or any other security mentioned at any time without notice.

This content is for a financially sophisticated audience. Treat it as one data point—not gospel.

Nice written