$SEZL: Sizzle or Fizzle?

Why This 60% Grower With 34% Margins Could Be the Most Asymmetric Setup in Fintech

Sezzle Inc. SEZL 0.00%↑ is a buy-now-pay-later (BNPL) provider operating primarily in the U.S. and Canada, offering consumers the ability to split purchases into installments (typically four or five payments) at no or low interest. Merchants partner with to boost sales, paying Sezzle a fee for each transaction, while Sezzle manages consumer installment collections.

Sezzle differentiates itself as a “purpose-driven” fintech focused on financial empowerment – e.g. it allows payment rescheduling, provides budgeting tools, and recently launched features like Pay-in-5 plans and financial education rewards (Money IQ) to deepen user engagement. The company was founded in 2016 and went public via the ASX before uplisting to NASDAQ under ticker SEZL 0.00%↑ ; it’s now headquartered in Minneapolis, MN.

📌 Basic Info

Ticker: SEZL 0.00%↑

Market Cap: $2.7B

Industry: Fintech / BNPL

Exchange: NASDAQ

Type: High Grower

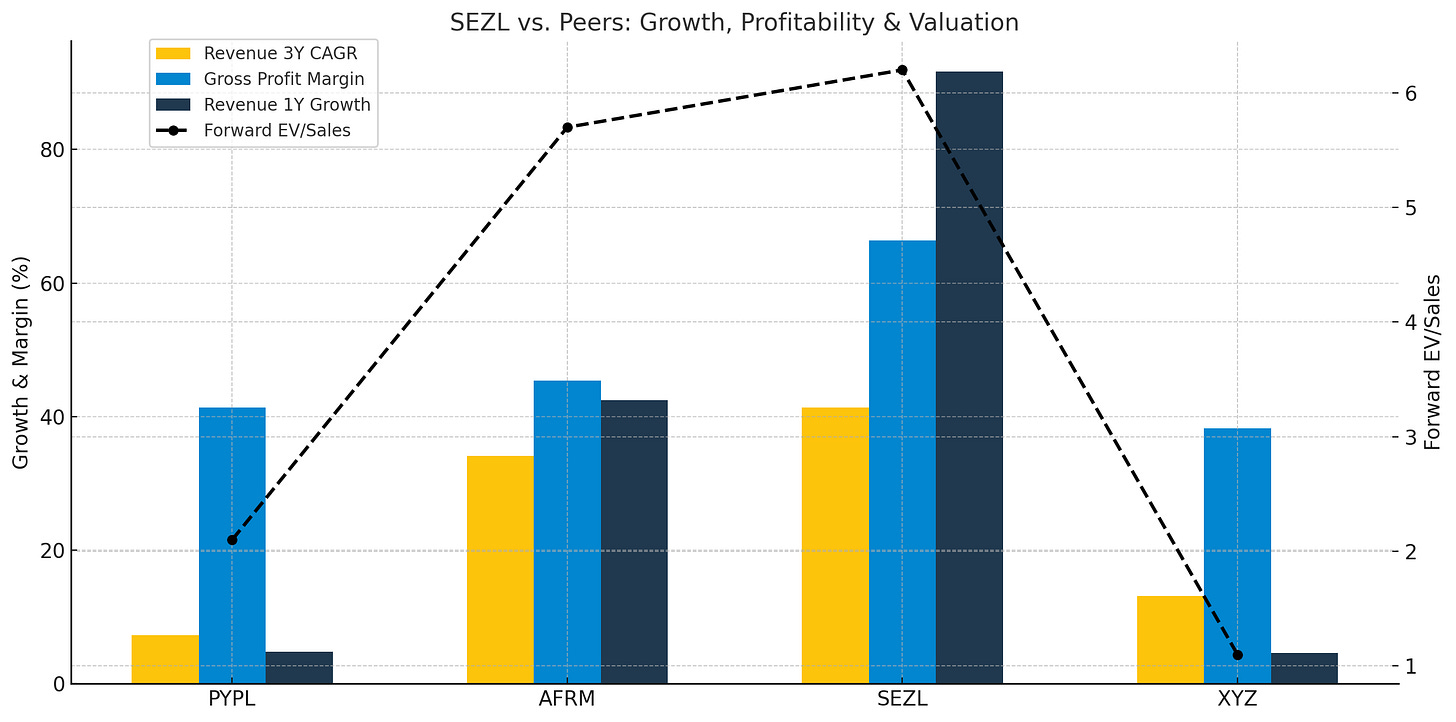

Sezzle just posted one of the cleanest quarters I’ve seen in fintech. In Q1 2025, they delivered a 123% YoY revenue surge, 34% net margins, raised full-year guidance by 50%, and crushed estimates on all fronts. But what makes this really interesting isn’t just the quarter—it’s the setup. SEZL 0.00%↑ is a rare breed: a high-growth, capital-light BNPL platform that’s already profitable, gaining share, and still trading at a steep discount to peers like AFRM 0.00%↑ and Klarna.

Below is my full breakdown of SEZL 0.00%↑ using my asymmetric investing template. If you want a fast-growing, underfollowed stock with optionality, strong management alignment, and real earnings power, this is a name worth tracking.

1. Management Alignment

Founder/CEO Charlie Youakim owns 44% of the company

Founder & CEO Charlie Youakim is a repeat founder with a track record. He built Passport (mobile parking payments), then bootstrapped Sezzle from scratch into a public company serving millions.

Equity-heavy compensation tied to GMV/net income targets

Just executed $25M buyback (0.8M shares) in Q1 — first ever

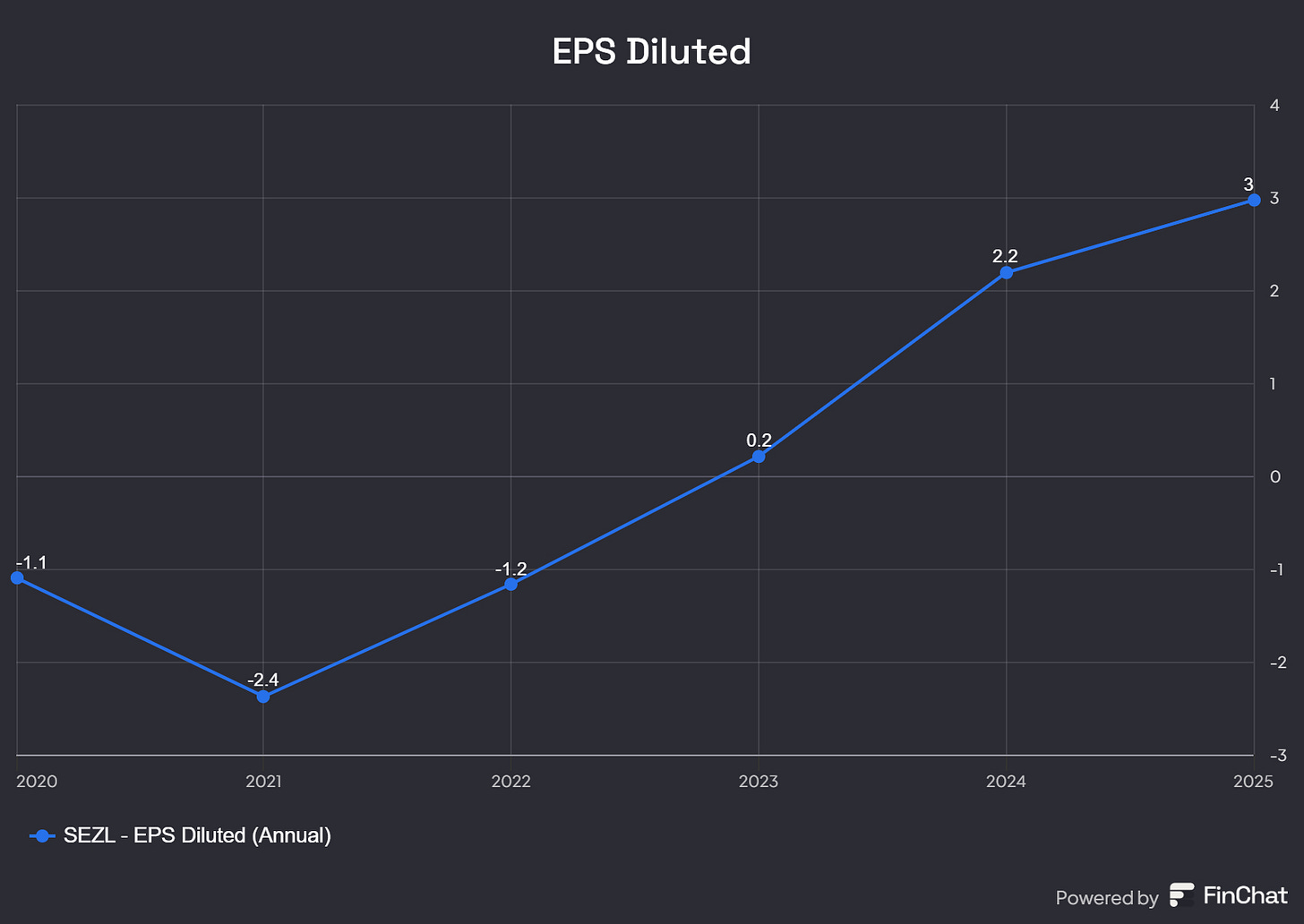

2. EPS Trend

From -$1.2 in FY22 to $3.25 guided EPS for FY25

Huge inflection in LTM earnings power

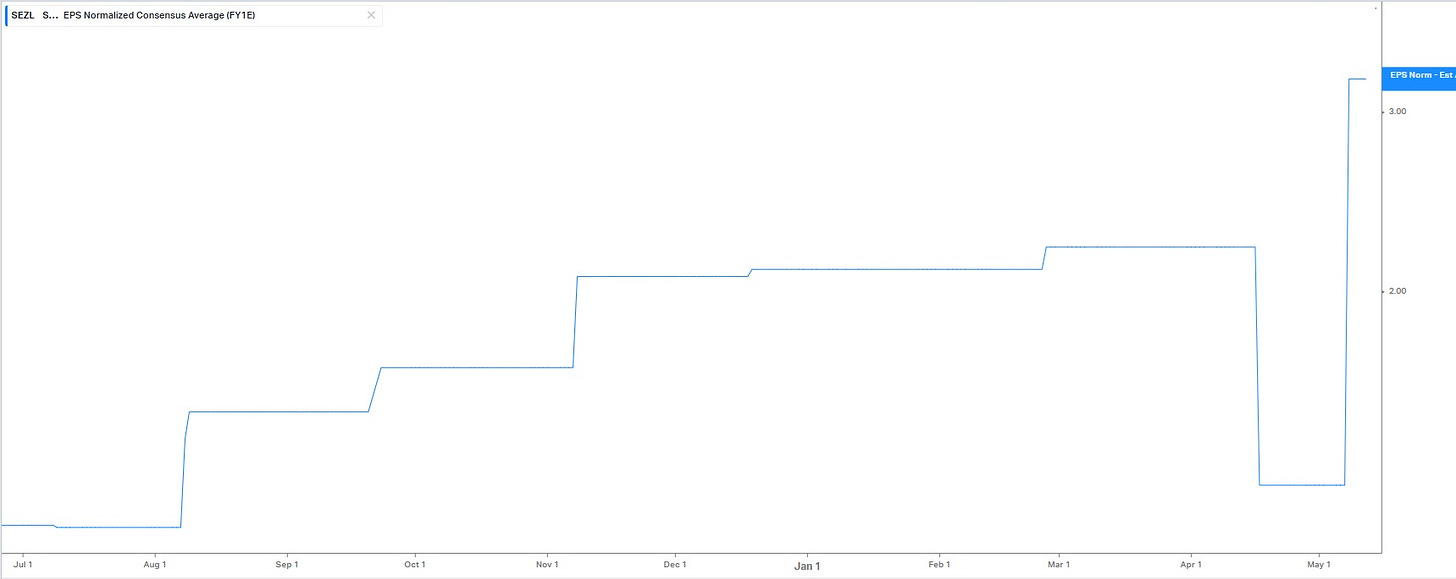

3. Earnings Surprise History

Four consecutive beats

Q1 2025 EPS beat >300% vs. consensus

4. Valuation

Forward P/E: ~27X FY25 EPS (guidance)

EV/EBITDA ~14X 2025E

FCF yield now positive

5. Growth Potential

Rev CAGR (2020-25e): 50%

EPS inflecting off a low base

TAM: $10T+ consumer spend; GMV <0.05% share

6. Blow-Up Risk

Net debt: $65M

Strong balance sheet ($82M cash)

No liquidity issues, low leverage

7. Technical Setup

Price >50/150/200dma

RSI mid-60s — no exuberance

8. Classification

Peter Lynch: High Grower

9. TAM

The BNPL market’s TAM reflects a paradigm shift in consumer finance. In the U.S., the addressable market will exceed $140 billion by 2025, while global transaction volumes could approach $1 trillion by 2030.

Given that BNPL currently accounts for less than 5% of total retail transactions in the U.S., there is considerable room for growth within this expansive market. In America, the purchase volume of credit and debit cards was US$10.4 trillion in 2022.

U.S. BNPL GMV forecast: $290B by 2030

Sezzle current GMV: $2.6B (FY24)

10. Consensus Estimate Trend

FY25 EPS revised up +40% since Feb

11. Achievability

Mix shift to subscriptions + On-Demand

Transaction losses just 12% of revenue

Margin profile resembles software

12. Analyst Coverage

Only 5 sell-side shops cover it

Under-followed = opportunity

13. Growth Drivers

Virtual card ramp

Pay-in-5 launch

Larger-ticket loans via WebBank

14. Key Risks

U.S. late fee regulation

Funding cost spikes

Apple/PayPal margin pressure

15. Moat

42-day loan cycle = ultra fast cash turn

Proprietary streak-based underwriting data

16. Ownership Base

Insider: 50%

Top institutional: BlackRock, Inc.

17. Optionality

Sezzle Up = credit builder

White-label risk engine for banks

18. Customer Sentiment

Trustpilot: 4.2/5

Recurring complaint: rescheduling fee confusion

19. Dilution Discipline

Most high-growth fintechs dilute aggressively.

Negative FCF, equity comp, and round-after-round of funding have become the norm.

But not at Sezzle.

🧮 Total shares outstanding grew just 2.1% CAGR over the past 5 years—

From 31.1M in 2020 to 34M in 2025.

That’s less than 10% dilution total, while revenue and profitability exploded.

There’s no runaway SBC, no endless fundraising.

This is a rare fintech compounding earnings without burning equity holders.

And honestly that’s one of the things I love most about the setup.

⚖️ Peer Comparison: SEZL vs Affirm, Paypal, Afterpay

Sezzle has the fastest growth, highest margin, and cleanest setup. It’s the only one of the four delivering sustained profits with expanding optionality.

⚡ What Drove the Beat?

Revenue: Not just volume — subscriptions and On-Demand (card) revenue up 300% YoY

EPS: Operating leverage from flat fixed costs + falling credit losses

Margins: 60% gross margin; 34% net margin

These are not one-off. The drivers are sustainable unless underwriting loosens or credit risk spikes.

⚠ Risks

Regulation (fee caps, consumer protection)

Consumer credit cycle turns

BNPL competition from Apple, PayPal, Block

FX and funding cost surprises

★ Our Take

Sezzle has crossed from speculative fintech to profitable compounder. This is one of the cleanest BNPL stories on the market:

Growing >60%

Net margins >30%

Founder-led and shareholder-aligned

Short-cycle loans reduce duration and credit risk

At 28X NTM earnings, it’s priced more like a SaaS turnaround than a hyper-growth fintech.

I see 6:1 upside/downside over the next 12 months with near-term catalysts in Q2 and Q3.

Buy on pullbacks to 50dma (~$72). Scale up on earnings beats + low credit-loss confirmations.

⭐ My PT: $188 Base, $291 Bull, $41 Bear

Sezzle doesn’t have to become bigger than Affirm or Klarna to produce outsized returns; it simply has to keep compounding revenue 35 %+, hold margins above 20 %, and let multiple expansion follow.

Today’s execution shows that outcome is more likely than not. Fifty-plus-percent growth forever? Unlikely. A durable 30–40 % CAGR with fat margins that beats every quarter for the next two years? Plausible—and that alone could still deliver a 3–5× from here.

So: Sizzle > Fizzle, with the caveat that we must watch credit metrics and regulatory chatter like hawks.

Stay sharp. Full earnings deep dives every week.

Subscribe for more high-conviction asymmetry.

📜 Disclosure

I currently hold a long position in Sezzle Inc. ($SEZL) at the time of writing. This write-up reflects my personal opinion and analysis, developed from publicly available information, filings, and earnings reports. It is intended for informational and educational purposes only and should not be considered investment advice, a recommendation, or a solicitation to buy or sell any securities.

Investing in equities—particularly in small-cap or high-growth companies like Sezzle—involves significant risk, including the risk of total capital loss. Always do your own due diligence and consult with a registered financial advisor before making investment decisions.

I reserve the right to buy, sell, or otherwise change my position in $SEZL or any other security mentioned at any time without notice.

This content is for a financially sophisticated audience. Treat it as one data point—not gospel.