Nebius: The AI Cloud Rocket Already Priced for Perfection

Explosive growth, NVIDIA backed, but already valued like a $3B, 20% margin business three years out.

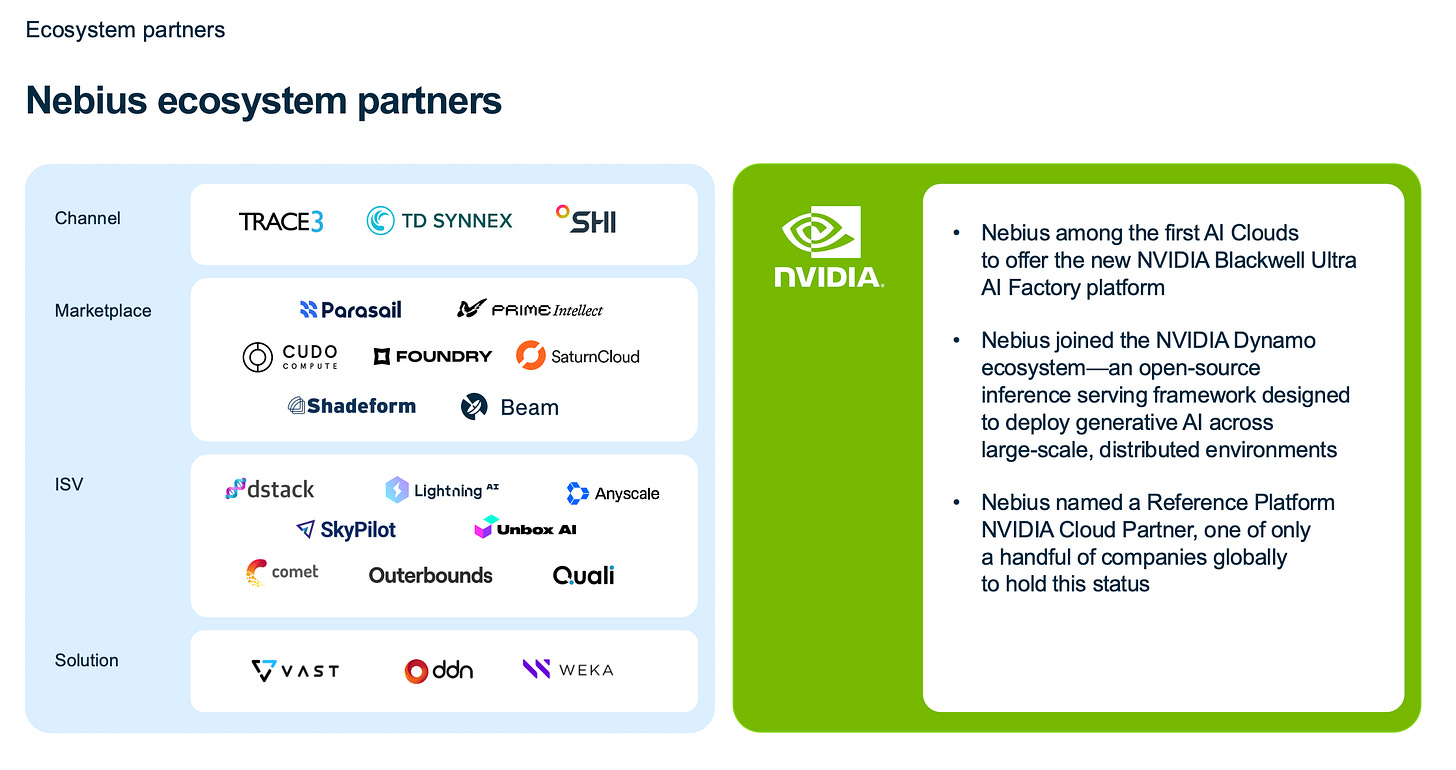

NBIS 0.00%↑ is the post Yandex, AI first infrastructure play. After Yandex N.V. sold its Russian assets in 2024 and rebranded, Nebius refocused on building AI cloud data centers across Europe and the U.S., with Arkady Volozh back in the CEO seat. In late 2024, Nebius raised $700M from strategic investors including NVIDIA and Accel providing fuel to scale GPU capacity.

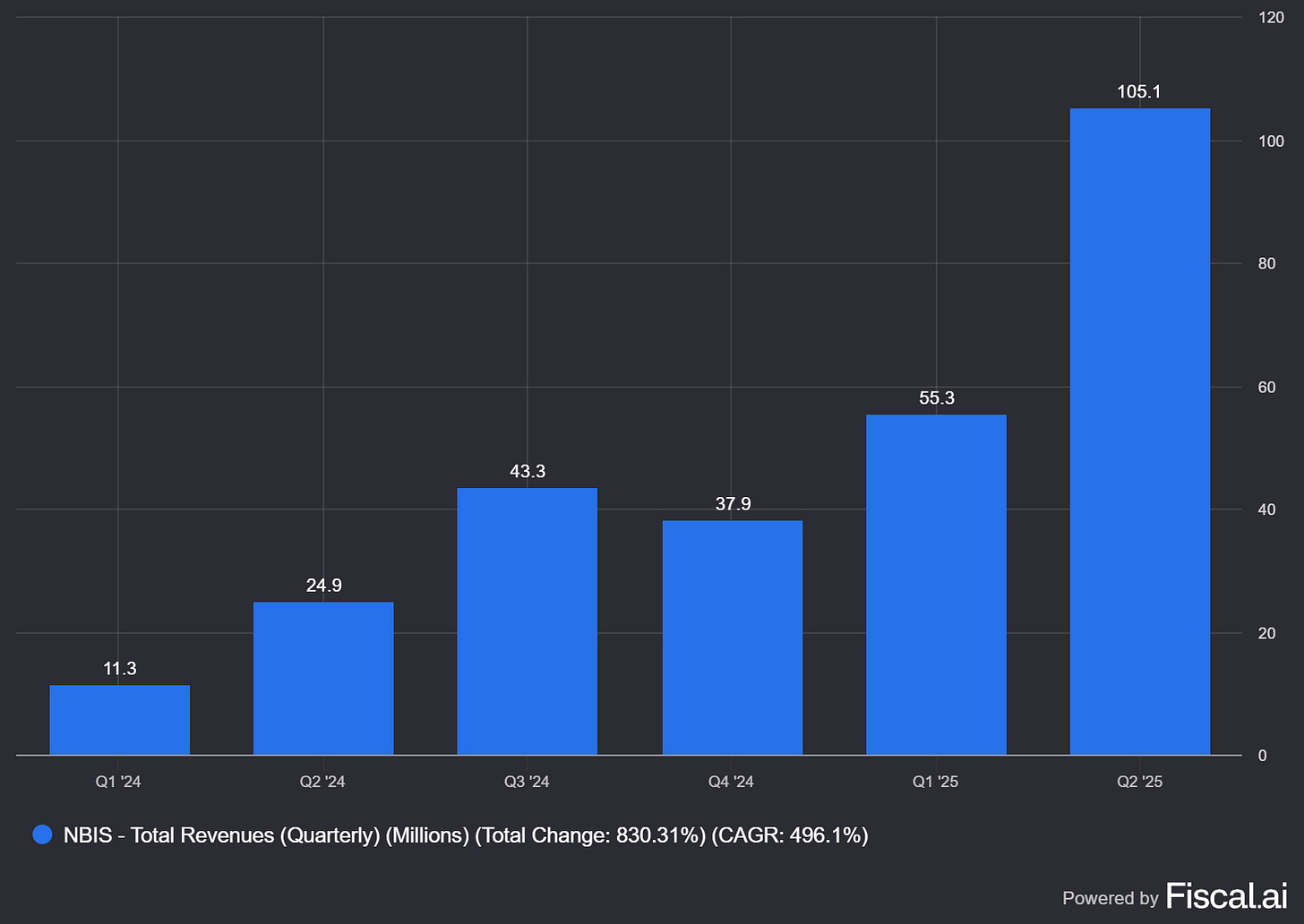

Execution has been fierce: Q2’25 revenue hit $105.1M (+625% YoY; +106% QoQ) and management lifted 2025 ARR guidance to $900M–$1.1B, noting the core AI cloud reached positive adjusted EBITDA ahead of plan. They’re “securing more than 1 GW of power by end 2026.” The stock ripped on the beat and raise.

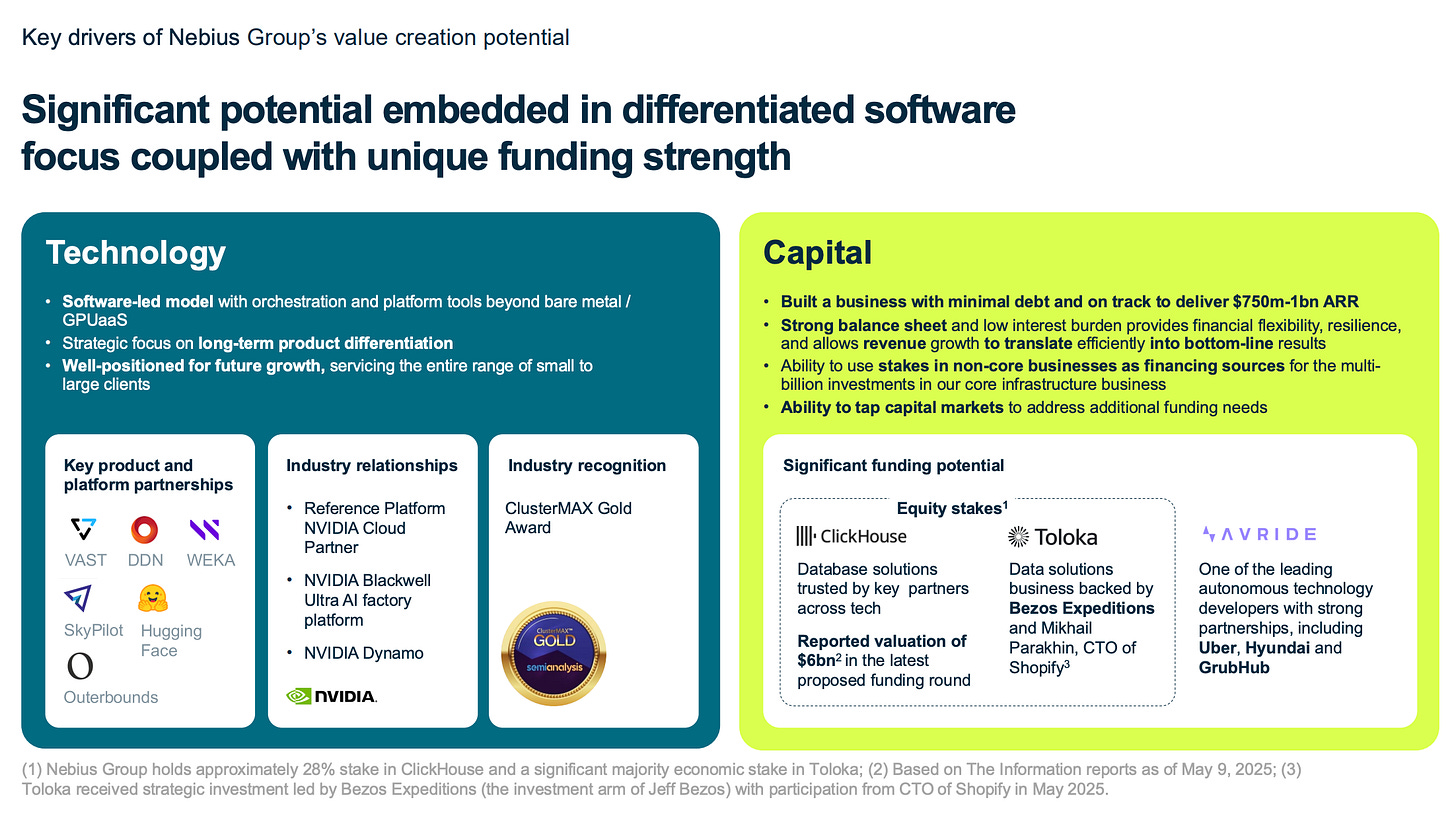

Nebius remains GPU cloud led, with optionality from smaller units (TripleTen, Avride) and strategic stakes, most notably 28% of ClickHouse (now valued $6.35B post-May 2025 round), a “funding flywheel” it could tap.

Big picture: Nebius is pushing to be the independent “AI cloud” alongside hyperscalers, lean, specialized, and priced to win developer mindshare.

Basic Info

Ticker / Company Name: NBIS – Nebius Group N.V.

Market Cap: $17–18B at $70/share after the Aug 7, 2025 post earnings jump (shares moved +27% on the day).

Sector / Industry: Technology – AI Cloud Infrastructure (GPU-based cloud computing for AI/ML).

Country / Listing: Netherlands (HQ: Amsterdam) / NASDAQ (U.S.).

Stock Type: High Growth (hyper scaling revenue; not yet profitable).

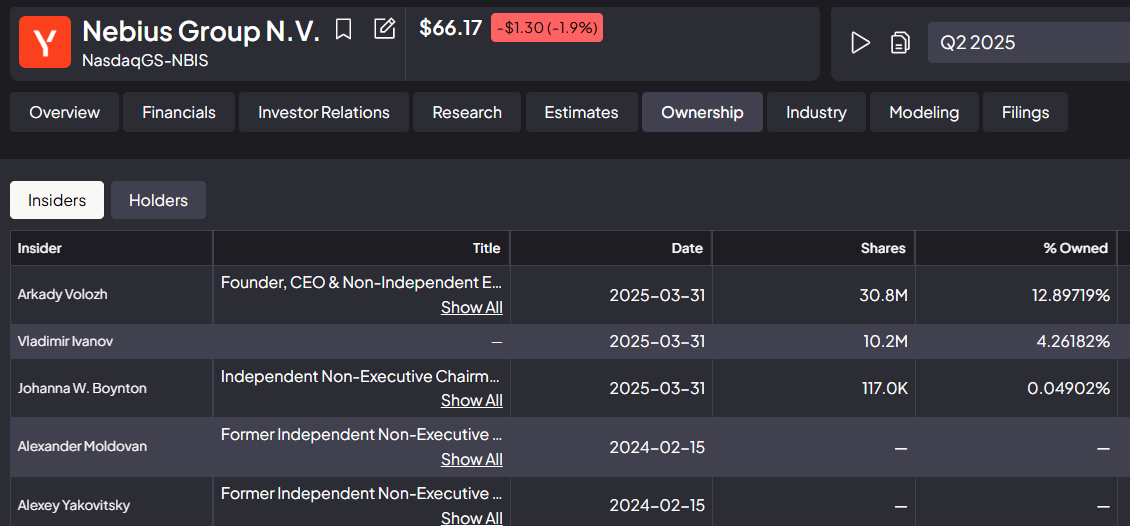

1) Management Alignment

Founder/CEO Arkady Volozh (largest shareholder) is back running the show; insider ownership is meaningfully double digit, and compensation skews equity heavy. The strategy is consistent: divest legacy exposure, raise growth capital, pour it into AI infra, and selectively monetize non core assets.

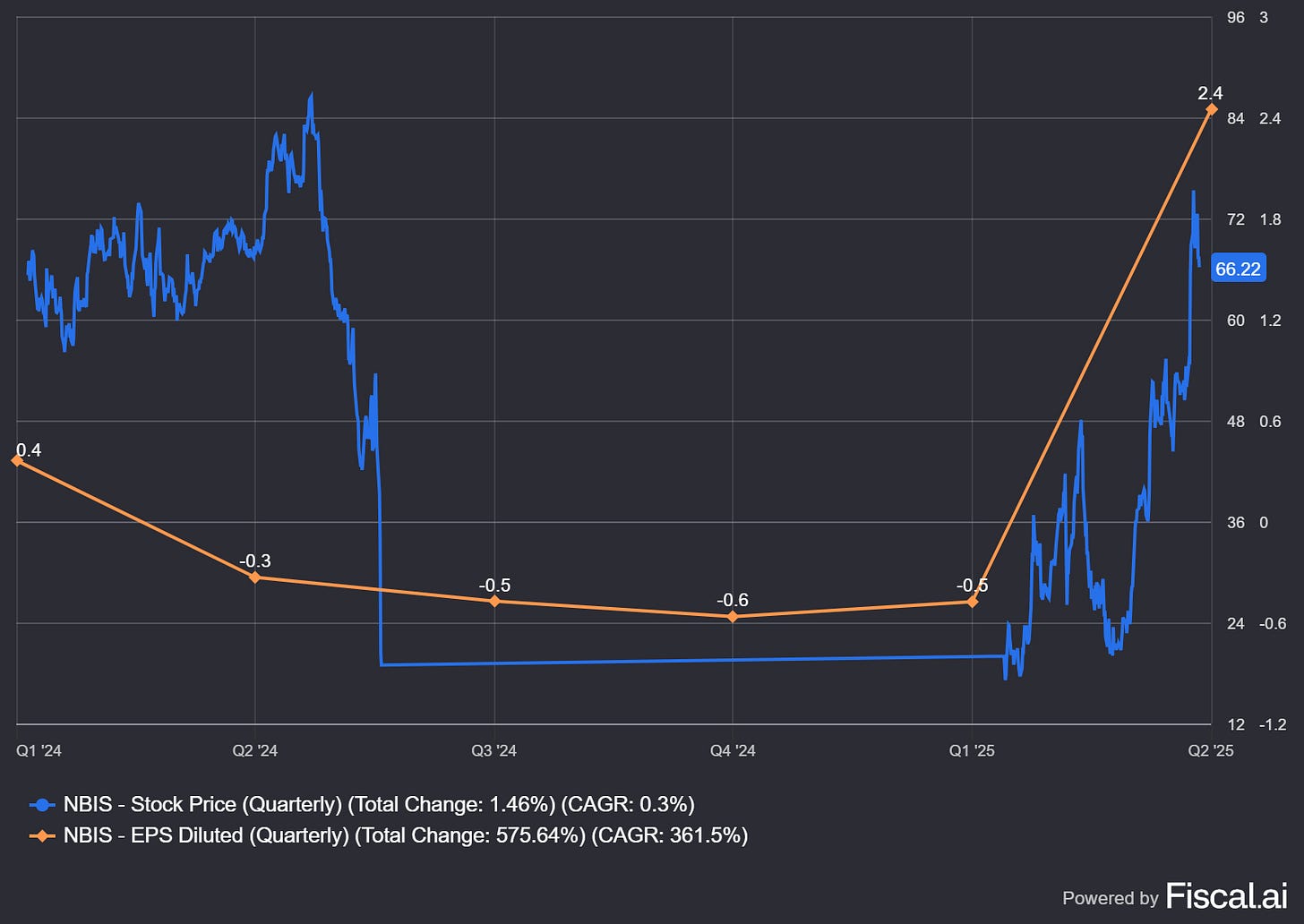

2) EPS Trend

Still loss making by design. 2024 net loss and 2025 quarterly losses persist, but losses as % of revenue are narrowing as scale improves. Core AI cloud turned adjusted EBITDA positive in Q2’25 even as group EBITDA remained slightly negative due to investment. Path to breakeven is plausible if utilization stays high.

Note: Q2 EPS spike reflects a non-recurring $597M gain on sale of investments. It does not indicate sustained operating profitability; GAAP EBITDA remained negative in Q2.

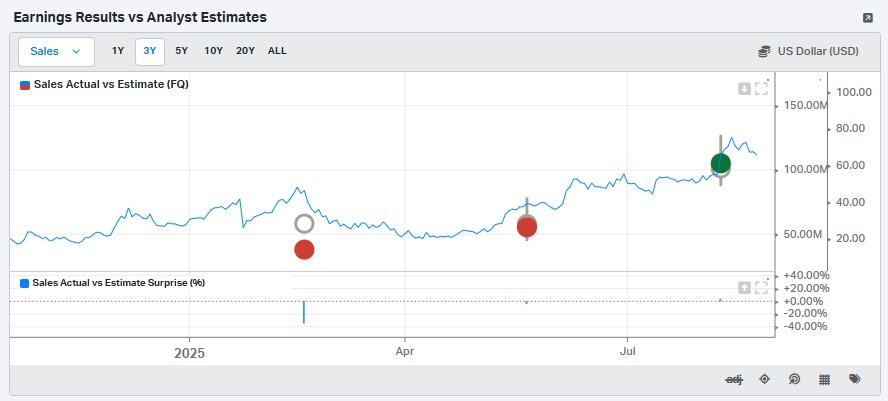

3) Earnings Surprise History

Short public track record, but revenue beats and guidance raises are the pattern. Q2’25: $105.1M revenue (beat), ARR raised; EPS slightly below consensus (-$0.44 vs -$0.41). Shares spiked 27% on the print.

4) Valuation

By traditional metrics, Nebius’s valuation is rich, reflecting its hyper-growth profile. The stock trades at very high multiples of current earnings (no P/E since earnings are negative) and sales. On a trailing basis, P/S is astronomical (over 100X 2024 revenue). Even on forward metrics, it’s elevated: at $70/share ($17B market cap), Nebius is valued around 28X 2025E sales and 11X 2026E sales (using $600M 2025 and $1.5B 2026 consensus revenue)

5) Growth Potential

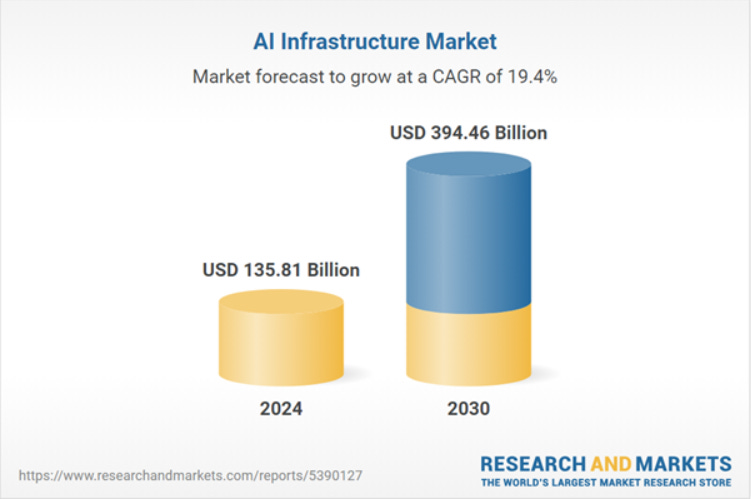

This is where Nebius shines. The company’s growth rates are extraordinary and the market opportunity (TAM) is enormous.Demand for AI compute is exploding; Nebius’ ARR targets imply triple-digit growth through 2025 with new capacity coming online. Management says >1 GW power by 2026; if utilization stays tight, 60–70% gross margins at scale are not crazy. TAM for AI infra is massive, with credible estimates pointing to $300–400B+ by 2030, and cloud overall toward $2T.

6) Blow-Up Risk

Despite its promise, Nebius carries meaningful risks that could “blow up” the thesis. Firstly, debt levels and cash burn need monitoring. Nebius has been raising capital to fund expansion – it held $1.4 billion cash after the 2024 funding and issued convertible notes in 2025

Cash burn / capex: 2025 capex plan upped to $2B, execution hiccups or tight credit could sting.

Governance/history: post-Russia optics have improved, but it’s a watch-item.

Tech dependence: NVDA 0.00%↑ supply/pricing and chip roadmaps matter; any paradigm shift (e.g., non-GPU) would bite.

7. Technical Setup

New uptrend post-relisting; powerful post-earnings breakout. Expect high beta and shakeouts; pullbacks to higher support (e.g., 50-DMA) are likely entry drama points.

8) Stock Classification

Fast Grower / early-stage, AI-cycle amplified .

9) Total Addressable Market (TAM)

Nebius plays the AI infra layer, compute + software + services. Credible industry work pegs AI infrastructure $394B by 2030, while cloud overall pushes toward $2T. Nebius is EU based with multi region capacity (Finland, Paris, U.S.) and an expanding enterprise logo list (developer ecosystem plus names like Cloudflare appearing across partner/customer lists). There’s runway.

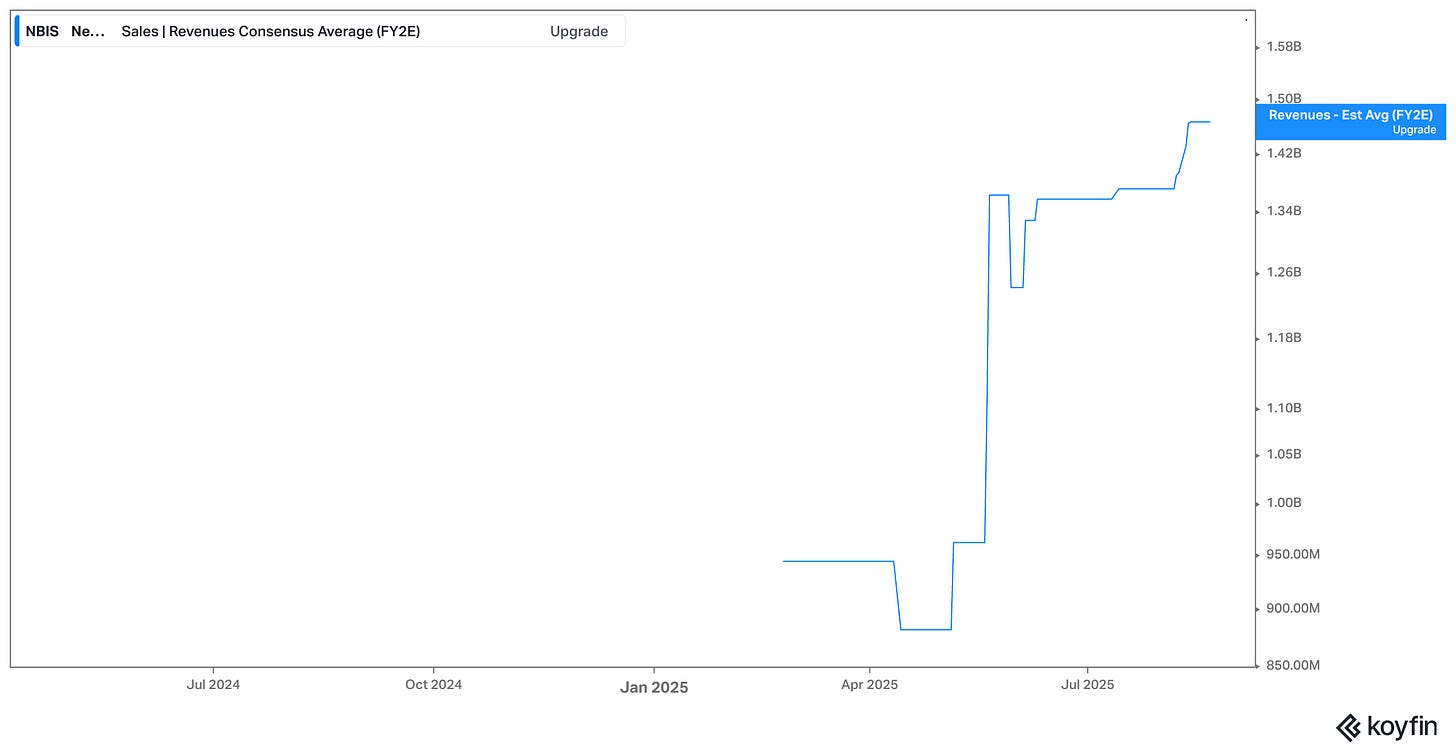

10) Consensus EPS/Revenue Trend

Street models embed a steep H2’25 ramp (Q3 $170M revenue) and $1.5B+ in 2026, losses narrowing into 2026. The revisions trend has been upward after each beat. Bar is high

11) Achievability of Consensus

Doable with clean execution: GPUs delivered, sites energized, utilization kept high. NVIDIA partnership (hardware + DGX Cloud routes) helps. Slipups on buildouts or any demand air pocket could sting given how aggressive the quarterly bars now are.

12) Analyst Coverage

Still light but growing; bias is Buy/Strong Buy with clustered targets around high-$60s–$90s. Expect broader coverage if Nebius strings together more clean quarters.

13) Growth Drivers

GenAI demand => secular tailwind.

Capacity expansion => direct revenue unlock; pipeline ready to fill new clusters.

Ecosystem integration (DGX Cloud, popular AI frameworks) lowers switching friction.

AI Studio (per token inference) adds higher level services and stickiness.

14) Risks

The most glaring risk is that giants like Amazon AWS, Microsoft Azure, and Google Cloud could use their vast resources to compete more aggressively in AI infrastructure. Currently, Nebius has an edge in focus and possibly pricing (it claims 30% lower cost for GPU compute vs major clouds), but if AWS or Azure decides to deeply discount GPU instances or bundle them with other services, it could squeeze Nebius. Moreover, hyperscalers have entrenched enterprise relationships, many big companies might simply default to their existing cloud provider for AI needs, limiting Nebius’s reachable market.

CoreWeave CRWV 0.00%↑ can compress pricing and raise the service bar; any support/ops missteps get punished. If GPU cloud supply outstrips demand in 12–24 months, price wars could hit margins. Compliance/security is table stakes.

15) Moat / Competitive Advantage

Focused AI-only stack, aggressive pricing (reports suggest up to 30% cheaper than hyperscalers for comparable workloads), early access to top-tier NVIDIA parts, and EU footprint for data sovereignty. Not unassailable but enough to keep winning mindshare with AI-native teams right now.

16) Ownership Base

Founder led, strategic investors (incl. NVIDIA), and a mix of institutions/retail. Insider ownership is solidly aligned; largest holder is the founder CEO.

17) Optionality

The 28% ClickHouse stake is real and liquidish; May 2025’s round at $6.35B implies a meaningful $ value that can fund growth or be spun/offloaded, plus smaller options (TripleTen, Avride) and new platform layers (inference, managed services).

18) Customer Sentiment

Developers praise performance and price; caveats are support response times and narrower non-AI services vs hyperscalers, normal for a company at this stage but a must-improve as enterprise mix rises.

19) Social Sentiment & Alt Data

Buzz is climbing (Reddit/FinTwit/tech blogs). It’s not meme-y; more “under the radar AI infra pure play” chatter. Hiring and press cadence support momentum. Keep it in perspective: sentiment is bullish but not euphoric.

20) Perception Gap

Two things the market may underweight:

Hidden assets (ClickHouse stake) that extend runway without painful dilution.

Niche edge, being AI only with pricing flexibility and dev friendly tooling in EU/US can matter longer than generalists assume, even as hyperscalers respond. (Flip side: current price already bakes in a lot.)

21) Valuation Targets

DCF/SOTP cross-checks point to $60–$70 base-case fair value today; upside (mid-$80s+) requires sustained hypergrowth and earlier profitability. That aligns with recent independent work that flags the stock as fairly valued post pop unless execution keeps outrunning estimates.

Back of the Napkin

Consensus FY2027 Revenue: $3.0B

EV today (at $66.6/sh): $15.4B

Net Cash: $0.49B

Shares O/S: 238.7M

EV/Sales Multiple Check

Current valuation = 5.1X 27E sales.

Sensitivity:

4X → $52/share

5X → $65/share

6X → $77/share

8X → $103/share

EV/EBITDA Lens (on $3B sales)

If EBITDA margins scale to:

15% margin ($450M EBITDA) → Implied 34X EV/EBITDA at today’s EV.

20% margin ($600M) → Implied 26X

25% margin ($750M) → Implied 21X

👉 To justify $66–67/sh at a growthy 22X EV/EBITDA, Nebius must hit 23% margins on $3B.

What It Means

Upside path: If Nebius can sustain 6–8X EV/Sales and/or deliver 25% EBITDA margins, the stock pushes toward $80–100+ by 2027.

Downside path: If multiples normalize to 4–5X, shares settle closer to $52–65, even if revenue ramps as planned.

Reality check: At today’s price, you’re already paying for both $3B revenue and a low-20s EBITDA margin glidepath. Execution must be near flawless !

📊 Scoring Summary (1–5 each)

Tier 1: 4/5 — Monster growth and aligned leadership; valuation keeps it from a clean 5.

Tier 2: 4/5 — Massive TAM + real catalysts; but competition/execution risks are non-trivial.

Tier 3: 2/5 — Story polished, sentiment strong; valuation full, fewer “undiscovered” angles.

Total: 10/15

📈 Final Take

Nebius is the cleanest public pure-play on AI infrastructure. Execution and capacity ramp are real, demand is secular, but the stock already bakes in $3B revenue and >20% margins by 2027. From here, upside depends on continued beat and raise and margin expansion; downside is fast if growth normalizes or pricing compresses. High risk / moderate near term reward; buy the story, prefer the pullbacks.

6–12 Month Outlook

Base path: Still operationally positive (new clusters, logo wins, high utilization), but the bar is high (Q3 $170M baked in). Expect smaller beats and more chop around prints.

Tape setup: Think range bound with downside risk if any hiccup shows up in capacity timing or pricing. My working band: $58–$80, skew higher only on clean execution and unmistakable ARR traction.

What would move it up: On time capacity + visibly sticky enterprise ramps + gross margin hold/improve.

What would hit it: Build slips, softer utilization, or early signs of pricing pressure from hyperscalers/CoreWeave.

2+ Year Outlook

Bull track: Scale to $2–$3B+ revenue by 27–28, prove 20%+ EBITDA margins, and defend a premium multiple, equity value meaningfully higher.

Bear track: Pricing/margin pressure as the field crowds in => growth normalizes, multiple compresses toward mainstream cloud, and returns lag.

Base case: Lands between, still fast growth, but with a more “normal” multiple and less multiple-driven upside. Execution, not narrative, does the lifting.

Risk/Reward Profile

Right now: High risk / moderate reward. Upside depends on margins + premium multiple sticking; downside is a swift rerate if growth cools or pricing cracks.

Translation: This is not an asymmetry anymore; it’s a show me story at a full price.

Entry / Exit Triggers

Enter/add on:

Pullbacks to rising support after prints or macro risk-off.

Confirmation: new capacity energized on time, ARR guide nudged up, gross margin holds/improves.

Trim/exit on:

Valuation overshoot without new fundamentals.

Guide or cadence slippage (build delays, weaker utilization).

Pricing pressure tells (discounting, lower realized $/GPU-hour).

Quality of earnings turns gimmicky (one-offs driving EPS while EBITDA/gross margin fade).

Position Size

Satellite, not core.

1–3% for most investors; 3–5% only if your conviction and risk budget are high (and you already manage AI exposure elsewhere).

Scale in/out around prints; use guardrails (mental stop or time-based review) so a sudden multiple compression doesn’t run the portfolio.

📜 Disclosure

I do not hold a position in Nebius Group N.V. ($NBIS) at the time of writing.

This write-up reflects my personal opinion and analysis, based on publicly available information, company filings, and earnings reports. It is intended solely for informational and educational purposes and should not be considered investment advice, a recommendation, or a solicitation to buy or sell any securities.

Investing in equities—particularly in high-growth companies like Nebius—involves substantial risk, including the potential for total capital loss. Always perform your own due diligence and consult a registered financial advisor before making investment decisions.

I reserve the right to buy, sell, or otherwise change my position in $NBIS or any other security mentioned at any time, without notice.

This content is written for a financially sophisticated audience. Treat it as one perspective—not gospel.

When you starting a discord or paid substack with positions ?

Very wrll done,amI read on x the story of Nebius is January but at 20 I thought it was expensive,today looks like positive news is already in;but palantir teaches us a different story..